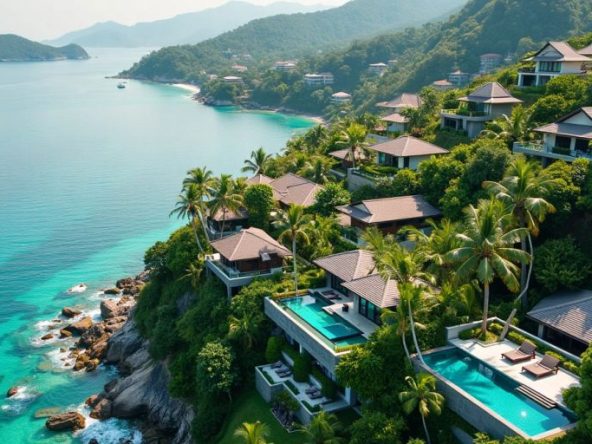

Thailand is a popular destination for property investment, attracting many foreigners with its beautiful landscapes and vibrant culture. However, buying property in Thailand can be complex due to its unique legal system. This article will guide you through the essential steps to avoid legal pitfalls and ensure your property ownership is secure.

Key Takeaways

- Foreigners face restrictions on owning land directly in Thailand, but options like leaseholds and setting up a Thai company can help navigate these limitations.

- A usufruct agreement allows foreigners to use and benefit from a property without owning it, provided it is legally registered.

- It is crucial to conduct thorough due diligence, including verifying title deeds and checking for any encumbrances or legal disputes.

- Consulting with a reputable lawyer can provide essential guidance and help you understand the legal fees and benefits of professional advice.

- Understanding local taxes, such as the House and Land Tax, is vital to avoid unexpected costs and ensure a smooth investment experience.

Understanding Thai Property Ownership Laws

Legal Framework for Property Ownership

Thailand’s property ownership laws are complex and can be challenging for foreigners to navigate. The legal framework is primarily governed by the Civil and Commercial Code, the Land Code, and various ministerial regulations. Foreigners are generally prohibited from owning land outright in Thailand. However, they can own buildings or structures on the land and up to 49% of the total area of all condominium units in a single building.

Types of Property Ownership

In Thailand, property ownership can be classified into several types:

- Freehold Ownership: This is the most secure form of ownership, where the owner has full rights to the property indefinitely.

- Leasehold Ownership: Foreigners can lease land for up to 30 years, with the possibility of renewal. This is a common method for securing property in Thailand.

- Condominium Ownership: Foreigners can own condominium units outright, provided that the total foreign ownership in the building does not exceed 49%.

Key Legal Documents

When purchasing property in Thailand, several key legal documents are essential:

- Title Deed (Chanote): This is the most secure type of land title and provides full ownership rights. It is crucial to verify the legitimacy of the title deed before purchasing.

- Sales and Purchase Agreement: This contract outlines the terms and conditions of the property sale. It should be reviewed carefully to ensure all details are accurate.

- House Registration Book (Tabien Baan): This document records the occupants of a property and is necessary for various administrative purposes.

When considering property investment in Thailand, always consult with experienced legal professionals to avoid potential pitfalls and secure your ownership rights.

Understanding these laws and documents is crucial for anyone looking to invest in the Phuket Real Estate Market, whether you’re interested in Villas For Sale Thailand, Luxury Villas For Sale, or the Best Beach Villas.

Restrictions on Foreign Ownership

Foreigners face significant restrictions when it comes to owning property in Thailand. Thai law prohibits foreign nationals from owning land outright. However, they can own buildings or structures on the land. Foreigners can also own up to 49% of the total area of all condominium units in a single building.

Legal Workarounds for Foreigners

Foreigners face significant restrictions when it comes to owning property in Thailand. However, there are several legal methods to secure property ownership.

Long-term Leaseholds

Foreigners can lease land for up to 30 years, with the possibility of renewal. This method allows for long-term use and enjoyment of the property without violating ownership laws. Long-term leaseholds are a popular choice for those looking to invest in Thai real estate without the complexities of ownership.

Setting Up a Thai Company

Another workaround is setting up a Thai company. Foreigners can hold up to 49% of the shares, while the remaining 51% must be owned by Thai nationals. The company can then purchase land and property. This method requires careful legal structuring to ensure compliance with Thai laws.

Investment-Based Ownership

Foreigners investing at least 40 million baht in Thailand may be eligible to buy up to 1 rai of land for residential purposes, subject to approval. This option is less common but provides a pathway for high-net-worth individuals to own property in Thailand.

When considering property investment in Thailand, always consult with experienced legal professionals to avoid potential pitfalls and secure your ownership rights.

Importance of Legal Advice

Choosing a Reputable Lawyer

When investing in property in Thailand, selecting a reputable lawyer is crucial. A seasoned property lawyer can guide you through the complexities of Thai property ownership laws, ensuring compliance with local regulations. Engaging a knowledgeable lawyer can significantly reduce the risk of legal complications. For instance, a property lawyer in Samui or Phuket can help you understand land ownership and lease agreements, making the process smoother.

Understanding Legal Fees

Legal fees can vary widely depending on the services required. It’s essential to understand the fee structure before engaging a lawyer. Typically, legal fees in Thailand may include:

- Consultation fees

- Document preparation fees

- Due diligence costs

- Contract review charges

Having a clear understanding of these fees can help you budget effectively and avoid unexpected expenses.

Benefits of Professional Guidance

Professional legal guidance offers numerous benefits, including:

- Risk Mitigation: Expert advice can help you avoid common legal pitfalls.

- Compliance: Ensures that all transactions comply with Thai laws.

- Peace of Mind: Knowing that your investment is legally sound provides peace of mind.

Seeking legal advice at every stage of a property transaction can significantly reduce the risk of disputes and legal challenges down the line.

In conclusion, the importance of legal advice in securing property ownership in Thailand cannot be overstated. From choosing a reputable lawyer to understanding legal fees and benefiting from professional guidance, each step is vital for a successful investment.

Navigating the Usufruct Agreement

Definition and Benefits

A usufruct is a legal arrangement that grants a person the right to use and benefit from a property they do not own. This is particularly useful for foreigners in Thailand, where land ownership laws are restrictive. A usufruct allows the holder to live in and derive income from the property without owning it.

Legal Requirements

To be valid, a usufruct must be registered with the Land Department. The registration process involves several steps:

- Drafting the usufruct agreement.

- Submitting the agreement to the Land Department.

- Paying a small registration fee, usually around 200 baht.

Failure to register the usufruct can result in the agreement being voided, leading to potential loss of rights.

Potential Risks

While a usufruct offers many benefits, it also comes with risks. If the property owner decides to sell the property or passes away, the usufruct can be challenged or invalidated. Therefore, it is crucial to ensure that the usufruct agreement is legally sound and registered properly. This involves understanding the specific terms, duration, and conditions under which the usufruct can be terminated.

Always seek reliable legal advice and adhere strictly to Thai property laws when considering property investments in the country.

In summary, a usufruct can provide a level of security and control over a property, but it is essential to understand the legal requirements and potential risks involved.

Conducting Due Diligence

Verifying Title Deeds

When purchasing property in Thailand, verifying the legitimacy of title deeds is crucial. The Land Department classifies titles into several categories, with some being more secure than others. Ensure the property has a Chanote title, which grants full ownership rights. Properties with other titles, like Nor Sor 3 Gor, may have boundary issues, leading to disputes.

Checking for Encumbrances

Before finalising any property transaction, it is essential to check for encumbrances. These can include mortgages, liens, or legal disputes that may affect the property’s value or your ability to sell it in the future. Engaging a reputable local attorney can help uncover any hidden issues.

Reviewing Developer’s Track Record

Investing in a property from a reputable developer is vital. Research the developer’s history and ensure they have a track record of delivering projects on time and to a high standard. Avoid mismanaged projects, as they can lead to construction delays and compromised quality.

Thorough due diligence is your best defence against potential legal and financial pitfalls in the Thai property market. Always verify all information and consult with legal professionals to ensure compliance with local laws.

Avoiding Environmental Regulation Pitfalls

Protected Areas and Zoning Laws

Thailand has specific laws and regulations regarding construction and land use in areas that are environmentally protected or considered of high ecological value. The pitfall for foreign buyers often lies in investing in properties located near national parks, beaches, forests, or other protected areas without fully understanding the restrictions in place. These areas can have stringent environmental regulations that restrict building, land development, or even land ownership. For instance, certain beachfront properties may have restrictions on construction to preserve the natural landscape and ecosystem. Conduct thorough due diligence to ensure that the property you are interested in is not within a zone where development is restricted or prohibited due to environmental reasons.

Legal Precedence in Thailand

Violating environmental regulations can result in legal penalties and forced demolition of any unlawful structures. It is crucial to understand the legal precedence in Thailand regarding environmental laws. Recent news articles have highlighted cases where properties were demolished because they violated environmental regulations. This underscores the importance of adhering to these laws to avoid significant investment losses.

Due Diligence and Verification

Conducting due diligence is essential to avoid environmental regulation pitfalls. Verify the property’s title deeds, check for any encumbrances, and review the developer’s track record. Engaging local professionals who are fluent in both Thai and your language can help bridge these gaps and ensure a smoother transaction. By thoroughly researching and verifying all aspects of the property, you can mitigate the risk of unforeseen challenges and safeguard your investment.

Understanding the Chanote Land Title System

When buying residential property in Thailand, understanding the Chanote land title system is crucial. This system is specific to Thailand and is essential for understanding property ownership rights.

Addressing Tax Implications

House and Land Tax

In Thailand, the House and Land Tax is a significant consideration for property owners, especially those involved in short-term rentals. This tax is calculated as a percentage of the annual rental value, typically ranging from 0.1% to 0.7% of the appraised value. Properties used for personal residence may be exempt, but those used for commercial purposes, such as short-term rentals, are subject to this tax. Understanding these conditions is crucial to avoid unexpected costs.

Proper understanding and planning for the House and Land Tax can help you avoid financial pitfalls and ensure a more accurate assessment of your investment’s profitability.

Transfer Fees and Stamp Duty

When transferring property ownership in Thailand, you will encounter transfer fees and stamp duty. The transfer fee is usually 2% of the appraised value, while the stamp duty is 0.5% of the sale price. These costs can add up, so it’s essential to factor them into your budget when planning a property purchase.

Tax Planning Strategies

Effective tax planning can help you maximise your investment returns. Consider consulting with a tax expert to understand the various deductions and exemptions available. For instance, certain expenses related to property maintenance and improvements may be deductible. Additionally, if you are renting out your property, you can offset rental income with allowable expenses to reduce your taxable income.

Engaging local professionals who are fluent in both Thai and your language can help bridge these gaps and ensure a smoother transaction.

Mitigating Risks in Property Transactions

When engaging in property transactions in Thailand, it is crucial to be aware of potential risks and take steps to mitigate them. This section will guide you through essential practises to ensure a secure and successful property acquisition.

Long-term Considerations for Property Ownership

Resale Potential

When buying property in Thailand, it’s important to think about its resale potential. Understanding the property’s resale potential and its appeal to future buyers can help you make a smart investment. For example, a 3-bedroom villa in Yamu, Phuket, offers freehold ownership and is just 500 metres from the beach. This makes it attractive for both permanent residence and investment.

Inheritance and Estate Planning

Creating a will is essential for designating executors who will oversee the distribution of your assets according to your wishes. This is particularly important in Thailand, where the default inheritance hierarchy may not align with your intentions. A well-drafted will can help circumvent potential legal complications and ensure that your property is distributed as you desire.

Trusts offer an additional layer of protection and tax efficiency. By transferring property ownership to a trust, you can retain control over the assets during your lifetime while ensuring they are distributed to your beneficiaries upon your death. This can help avoid probate and provide significant tax benefits.

Market Dynamics

The Thai property market is dynamic and can be influenced by various factors such as economic conditions, government policies, and tourism trends. Staying informed about these factors can help you make better decisions regarding your property investment. For instance, the demand for properties in popular tourist destinations like Phuket and Bangkok can fluctuate based on tourism trends and economic conditions.

Proactive management and regular maintenance are key to preserving the value and appeal of your property in Thailand. By engaging reputable services and planning for costs, you can ensure your property remains in excellent condition, even from afar.

Conclusion

Securing property ownership in Thailand involves navigating a unique legal landscape. Foreign investors must be vigilant and well-informed to avoid potential pitfalls. Engaging reputable legal professionals and conducting thorough due diligence are crucial steps in safeguarding your investment. By understanding and complying with local laws, you can successfully invest in Thai property and enjoy the benefits it offers. Remember, careful planning and expert advice are key to a secure and rewarding property ownership experience in Thailand.